The tax rewards are what make SDIRAs eye-catching For lots of. An SDIRA is often equally standard or Roth - the account kind you end up picking will rely largely on your own investment and tax approach. Check out together with your economic advisor or tax advisor in case you’re Uncertain which can be very best for you personally.

Being an Trader, nonetheless, your choices are usually not restricted to shares and bonds if you decide on to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Complexity and Duty: By having an SDIRA, you have got more control in excess of your investments, but You furthermore mght bear additional responsibility.

No, You can't invest in your own private company that has a self-directed IRA. The IRS prohibits any transactions concerning your IRA and your own enterprise as you, because the proprietor, are regarded as a disqualified human being.

Opening an SDIRA can give you access to investments normally unavailable via a lender or brokerage organization. Below’s how to start:

Criminals occasionally prey on SDIRA holders; encouraging them to open up accounts for the objective of producing fraudulent investments. They frequently idiot investors by telling them that if the investment is recognized by a self-directed IRA custodian, it have to be reputable, which isn’t true. Yet again, Be sure to do thorough due diligence on all investments you decide on.

Ease of Use and Technologies: A person-friendly System with on-line applications to track your investments, submit files, and control your account is crucial.

Assume your Buddy is likely to be commencing another Fb or Uber? With the SDIRA, you may spend money on triggers that you suspect in; and perhaps appreciate larger returns.

Increased Costs: SDIRAs typically include larger administrative fees when compared to other IRAs, as specific aspects of the administrative process can not be automated.

Because of this, they tend not to market self-directed IRAs, which offer the pliability to invest in a broader number of assets.

And because some SDIRAs including self-directed classic IRAs are matter to essential bare minimum distributions (RMDs), you’ll ought to prepare forward to make certain you might have adequate liquidity to meet The foundations set from the IRS.

Entrust can help you in obtaining alternative investments together with your retirement money, and administer the obtaining and promoting of assets that are typically unavailable as a result of banking institutions and brokerage firms.

Once you’ve located an SDIRA service provider and opened your account, you may be pondering how to really get started investing. Knowing both equally The foundations that govern SDIRAs, in addition to the best way to fund your account, may help to put the inspiration for the future of profitable investing.

Whether you’re a money advisor, investment issuer, or other fiscal Expert, take a look at how SDIRAs could become a strong asset to description develop your business and obtain your Skilled plans.

Creating essentially the most of tax-advantaged accounts permits you to maintain more of The cash which you invest and make. Based upon irrespective of whether you decide on a traditional self-directed IRA or maybe a self-directed Roth IRA, you've got the opportunity for tax-cost-free or tax-deferred advancement, provided specified conditions are fulfilled.

Homework: It is identified as "self-directed" for a cause. By having an SDIRA, you are completely to blame for thoroughly studying and vetting investments.

Real estate is one of the preferred solutions amid SDIRA holders. That’s since you can put money into any sort of property which has a self-directed IRA.

Limited Liquidity: Most of the alternative assets that could be held within an SDIRA, such as property, private equity, or precious metals, might not be simply liquidated. This may be a difficulty if you must access cash rapidly.

Introducing money on to your account. Remember that contributions are matter to once-a-year IRA contribution restrictions established from the IRS.

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Shane West Then & Now!

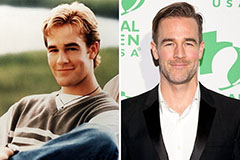

Shane West Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!